Hedge accounting and interest rate benchmark reforms

Contents:

In applying IFRS Standards, IFRS 104permits a direct consolidation viewpoint where a company may directly consolidate a lower-level subsidiary even if there are one or more intermediate subsidiaries. This allows the parent to apply a net investment hedge, in accordance with IFRS 9, on a lower-tier subsidiary even if the intermediary subsidiary has a different functional currency. Unlike IFRS Standards, US GAAP does not permit net investment hedging of the lower-tier subsidiary if there is an intermediary subsidiary with a different functional currency. Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients.

No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation. Understanding cryptocurrencies and other crypto assets and the accounting issues they raise. Access the diversified funds you need to make faster payments and manage your cash flow. Accounting MethodAccounting methods define the set of rules and procedure that an organization must adhere to while recording the business revenue and expenditure. Cash accounting and accrual accounting are the two significant accounting methods.

Transactions in over-the-counter derivatives (or “swaps”) have significant risks, including, but not limited to, substantial risk of loss. This material has been prepared by a sales or trading employee or agent of Chatham Hedging Advisors and could be deemed a solicitation for entering into a derivatives transaction. If you are not an experienced user of the derivatives markets, capable of making independent trading decisions, then you should not rely solely on this communication in making trading decisions. When the hedged item comes into play (i.e. the June revenue is finally recognized in June), then the stored up MTM changes for that June hedge will be released from OCI and into the income statement. Hedge accounting enables OCI to effectively store MTM changes until the timing of the hedge and hedged item finally align.

The argument against is that, if applied too broadly, it could allow firms to hide gains or losses. As such, strict rules are set on when hedge accounting can be applied – and many derivatives users insist their hedging strategies comply with these rules. A net investment hedge is used to hedge a company’s foreign currency exposure and reduce the potential reported earnings risk that may occur upon the future disposition of a net investment in a foreign operation. Benefit from the practical insights on the fundamentals of hedge accounting, hedge documentation and effectiveness testing as per IFRS 9 and developments on interest rate benchmark reforms.

Hedge accounting and interest rate benchmark reforms

“It is still one of the more challenging areas of classified balance sheet, and anyone looking to get into the world of hedge accounting definitely needs to do their diligence to apply the standard in an informed manner,” Goetsch said. The IASB considered whether equity investments at fair value through other comprehensive income could be eligible to be hedged items. The IASB discussed the proposals in the hedge accounting exposure draft related to hedging groups and net positions. The loan is accounted for at amortised cost, meaning any changes in its fair value are ignored.

- However, dividends do not impact earnings and, therefore, cash flow hedge accounting cannot be applied to this transaction.

- This means that when an asset is hedged with a derivative, the derivative’s gains and losses are not counted towards profit and loss but are instead counted towards Other Comprehensive Income.

- A fair value hedge may be designated for a firm commitment or foreign currency cash flows of a recognized asset or liability.

An effective method to determine hedge effectiveness would be the one having a blend of quantitative analysis and qualitative criteria. Requiring a new disclosure that will provide investors with more information about basis adjustments in fair value hedges of interest rate risk. There are strict qualifications that must be satisfied in order that hedge accounting may be used, including for example that the hedge can be shown to be effective. Hedged liabilities are measured at fair value through equity, which can lead to a discrepancy between the hedged asset and the hedge instrument. Certain non-derivative financial assets or non-derivative financial liabilities. The Roadmap series contains comprehensive, easy-to-understand accounting guides on selected topics of broad interest to the financial reporting community.

IFRS 9 requires only prospective assessment of hedge effectiveness on an ongoing basis, at inception of the hedging relationship and at a minimum when a company prepares annual or interim financial statements. Unlike IFRS 9, US GAAP requires a prospective and a retrospective assessment whenever financial statements are issued or earnings are reported, and at least every three months. Many financial institutions and corporate businesses use derivative financial instruments to hedge their exposure to different risks (for example interest rate risk, foreign exchange risk, commodity risk, etc.). Some entities mitigate certain risks by entering into separate contracts that meet the definition of a derivative instrument.

APPLYING HEDGE ACCOUNTING

These are liquid assets because the economic resources or ownership can be converted into a valuable asset such as cash. Functional CurrencyThe term functional currency represents the currency of the location in which business operates primarily, earns a significant portion of revenue, and incurs the cost to generate such profits. In short, it is the home currency of that country where the corporate headquarter is situated. FX Forward contracts allow two parties to exchange foreign currencies on a pre-defined future date at a pre-defined exchange rate.

An allowance for doubtful accounts is a contra-asset account that reduces the total receivables reported to reflect only the amounts expected to be paid. Hedge accounting uses one entry to adjust the fair value of a security and its opposing hedge. The Invisible Vault Podcast Series On this podcast series, top finance leaders from around the world share their secrets, strategies, and tactics for managing liquidity and creating value.

What Is Hedge Accounting?

It may mean that a derivative instrument exists within another contract or instrument. It is important to carefully consider an entity’s inherent financial risks when designing a risk management policy in order to determine whether derivative instruments will effectively mitigate some of these exposures. ASC 815 “Derivatives and Hedging” provides guidance on a complex area of accounting. Derivatives are highly leveraged instruments that provide each party exposure to an economic risk without significant upfront costs. Derivatives are mainly used by entities to mitigate risk by offsetting existing financial exposures.

Hedge accounting of the foreign currency risk arising from a net investment in a foreign operation will apply only when the net assets of that foreign operation are consolidated. The amendments in the new standard will permit more flexibility in hedging interest rate risk for both variable rate and fixed rate financial instruments, and introduce the ability to hedge risk components for nonfinancial hedges. The objective in developing the new standard was to better align the accounting rules with a company’s risk management activities, and to simplify the application of the hedge accounting standard. Hedge accounting is designed to ensure that hedging instruments and hedged items both receive similar accounting treatment. Companies can use hedge accounting for transaction exposures, such as forecasted purchases, revenues and expenses in foreign currencies.

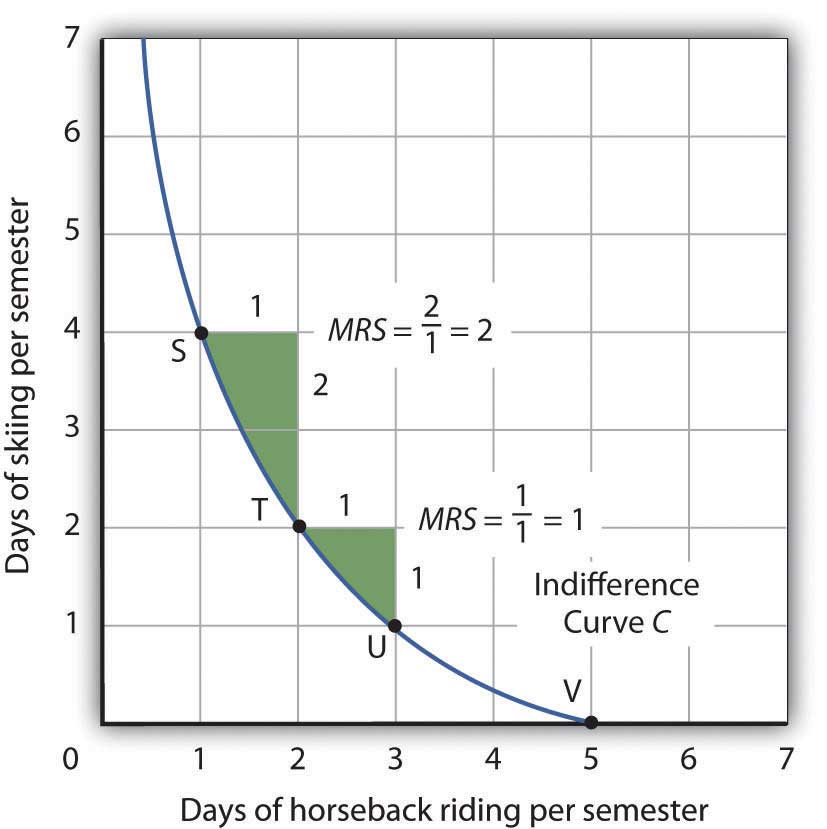

The project involves a comprehensive review of hedge accounting requirements, to establish a more objective-based approach to hedge accounting and align it with an entity’s risk management processes. Hedge effectiveness is determined at the inception of the hedge relationship, and through periodic prospective effectiveness assessments to ensure that an economic relationship exists between the hedged item and the hedging instrument. This means that when an asset is hedged with a derivative, the derivative’s gains and losses are not counted towards profit and loss but are instead counted towards Other Comprehensive Income. A company may need to buy or sell foreign currency at some point in the future to fulfil a contractual obligation. To protect against the risk that the value of the foreign currency will change between the time the company agrees to the contract and when they need to buy or sell the currency, they can enter into a hedge. A hedge is an agreement to buy or sell a currency at a set price on a specific date.

Under a cash flow hedge, the hedging instrument is measured at fair value, but any gain or loss that is determined to be an effective hedge is recognised in equity, i.e. under cash flow hedge reserve. This is intended to avoid volatility in the statement of profit and loss in a period when the gains and losses on the hedged item are not recognised therein. These swings impact the income statement, showing volatility that does not reflect the economic benefit of the hedge.

This is meant to reduce volatility created by repeated adjustments, a process also known as ‘mark to market’ or fair value accounting. For example, gold mines are exposed to the price of gold, airlines to the price of jet fuel, borrowers to interest rates, and importers and exporters to exchange rate risks. Hedge accounting is an accountancy practice, the aim of which is to provide an offset to the mark-to-market movement of the derivative in the profit and loss account.

Accounting Issues

As time passes, these forward contracts will change in their mark-to-market values, as any derivative would. By default, the changes in MTM would flow through the income statement as gains or losses. This is no different from how one would account for other financial instruments on a company’s books whose values are fluctuating. These conditions include having a formally documented risk management strategy, the hedging instrument being designated as a hedge, and the hedging instrument having a positive impact on the company’s financial statements. Current GAAP contains limitations on how a company can measure changes in fair value of the hedged item attributable to interest rate risk in certain fair value hedging relationships.

This is because full hedge accounting provides the most accurate reflection of the economic protection achieved from a hedge and provides the most useful information to users of the financial statements. Other providers offer multiple technologies to achieve what Kyriba delivers in a single cloud portal. Kyriba’s solution simplifies the support for your hedging program, but offers premium product performance, managed upgrades and eliminates IT dependencies. An entity should satisfy the broader disclosure requirements by describing its overall financial risk management objectives, including its approach towards managing financial risks. Disclosures should explain what the financial risks are, how the entity manages the risk and why the entity enters into various derivative contracts to hedge the risks.

For such circumstances, https://1investing.in/ 815 allows entities to use a specialized hedge accounting for qualified hedging relationships. An example of a fair value hedge is swapping a fixed interest rate investment for a variable one when interest rates increase, while at the same time converting any variable rate debt payouts to a fixed rate. Unlike a cash flow hedge, which mitigates the risk of a variable asset, fair value hedges prevent you from taking losses on fixed rate investments. Accountants are responsible for preparing financial statements that investors and company executives can use to make business decisions. A key element of the financial reporting process is tracking income and expenses, along with any gains or losses from investments.

Hedging: Favorable Tax Treatment Requires Careful Compliance … – JD Supra

Hedging: Favorable Tax Treatment Requires Careful Compliance ….

Posted: Wed, 05 Apr 2023 20:01:11 GMT [source]

If hedge accounting is not applied, changes in the fair values of derivative instruments are recognized in earnings in each reporting period, which may or may not match the period in which the risks that are being hedged affect earnings. Therefore, the objective of hedge accounting is to match the timing of income statement recognition of the effects of the hedging instrument with the timing of recognition of the hedged risk. Hedge accounting involves offsetting changes in the fair value of a financial instrument with changes in the fair value of a paired hedge. Hedges are used to reduce the risk of losses by taking on an offsetting position in relation to a financial instrument.